- I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE UPGRADE

- I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE SOFTWARE

- I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE PLUS

- I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE FREE

I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE FREE

(I could have deducted an additional $800 contribution for 2014, but I didn't.)Īfter the HSA made me ineligible for TurboTax's free service, the domino effect (a.k.a.

I had an HSA because Forbes had put $2,500 in it for me. But the real gotcha here was that I wasn’t claiming the HSA deduction, because I had not put any of my own money into the account. When the HSA money is withdrawn it isn't taxed, provided it's used for a qualified medical expense.

I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE PLUS

As an aside, for 2016, you can put up to $3,350 pretax into an HSA for a single or $6,750 for a family, plus another $1,000 if you're 55 or older. Turns out that TurboTax Federal Free Edition (which, remember, is the non Free File service) is offered only for forms 1040EZ or 1040A, which are simplified tax returns. This “upgrade” was deemed necessary because you can only claim the Health Savings Account deduction on a full-fledged 1040 and HSA holders must also submit Form 8889.

I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE UPGRADE

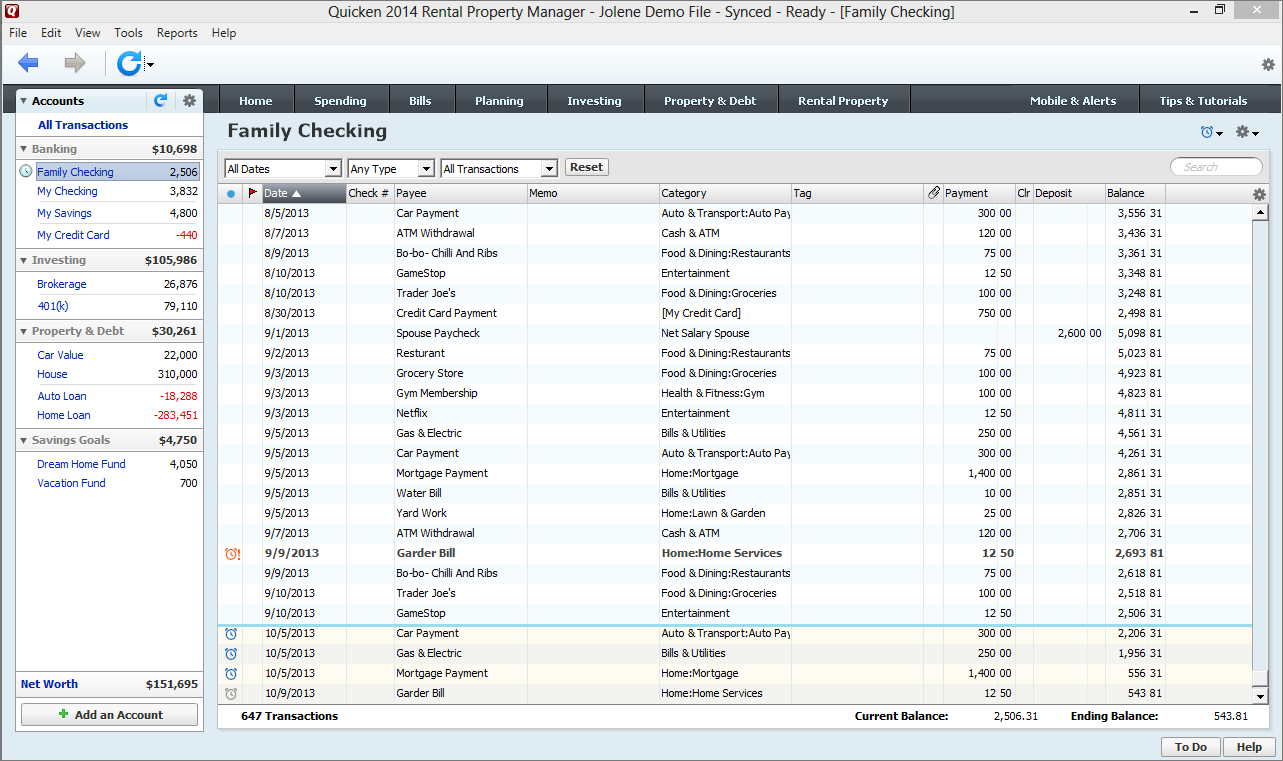

This IRS code told TurboTax that Forbes provides me with a Health Savings Account based on this TurboTax told me I would need to upgrade to the Deluxe edition, which at that moment Intuit was selling for $34.99.

I HAVE QUICKEN DELUXE 2016 WILL I STILL BE ELIGIBLE SOFTWARE

H&R Block product, which was used to file 7 million returns last year, and TaxAct, which was used for about 5.5 million.įor me, the first sign of trouble popped up when the software spotted the letter W in box 12 of my W-2. Other tax software works similarly, including the It then walks you through a questionnaire to determine the deductions and credits you might be eligible for, as well as what documents the IRS will need from you. In case you are not one of the 30 million people who filed with TurboTax last year, the program begins by importing your W-2s. Of course I had no clue about any of this last year, which is how TurboTax cost me over $100. In my case, however, that's irrelevant, since I wouldn't have qualified for TurboTax's Freedom Edition, with its $31,000 income cut-off. Moreover, if a low-income person who would qualify for the Free File Freedom Edition starts doing his or her taxes with Turbotax's Federal Free Edition and needs a form that is not supported in Federal Free, but is supported in the Freedom Edition, Intuit will not transfer the user to the Freedom Edition. What about that $62,000 cut-off? It turns out that while all 13 members of the Free File Alliance offer free filing to some subset of people making as much as $62,000 this year, they restrict that by age, state of residence or military status. That’s up to the budget strapped IRS.Īnd get this: Intuit only offers its Free File service to taxpayers with adjusted gross income of $31,000 or less for tax year 2015, unless they're active duty military. Bob Meighan, vice president of customer advocacy for TurboTax, responds that it is not the company’s responsibility to market the Free File Alliance product. Moreover, Intuit is barred from selling other services such as audit protection within the Freedom Edition (the company sees this as a weakness-you decide).Īnyway, the non-Free File Alliance version is what I found myself using through the TurboTax website. Turns out the Freedom Edition (the one that is part of the Free File program) supports a wider array of free tax forms. Now here's the key point, one I didn't realize last year: the TurboTax Federal Free Edition isn't actually part of the Free File program, whereas the TurboTax Freedom Edition is. (The cut off this year is $62,000 in 2015 adjusted gross income.) They agreed to provide free filing for low- and moderate-income taxpayers, but maintained the right to each set eligibility criteria around an income threshold. The companies, Intuit included, launched a nonprofit in 2003 under threat of free tax preparation by the IRS. This was because of something called The Free File Alliance, which is comprised of 13 tax software companies. That detail and my plain vanilla finances seemed, as far as I understood things, to easily qualify me to e-file my federal return for free. I have no investments outside of my 401(k) and my apartment is a rental.īut the most important thing to know for this story is that my 2014 income was less than $60,000. My living comes from one job at a company (Forbes Media) that counts me as an employee and thus reports my wages to the Internal Revenue Service on a W-2 and provides me with access to health insurance. A few basics should tell you I’m a fairly standard Millennial taxpayer.

0 kommentar(er)

0 kommentar(er)